Homebuyers thinking about buying a home in Georgia’s rural communities could have 100% NO down payment mortgage options thanks to the USDA rural housing loan! USDA RD loans are offered by approved USDA mortgage companies, banks and credit unions in select locations around GA.

Homebuyers thinking about buying a home in Georgia’s rural communities could have 100% NO down payment mortgage options thanks to the USDA rural housing loan! USDA RD loans are offered by approved USDA mortgage companies, banks and credit unions in select locations around GA.

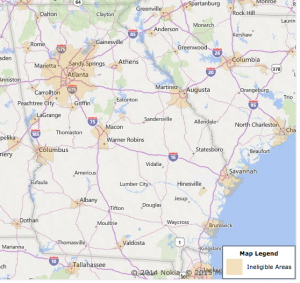

The great news is most of GA outside the immediate area of Atlanta, Augusta, Columbus and Macon are likely still approved $0 down USDA mortgage. Please see the USDA map snapshot for Georgia, the darker shaded areas are the ineligible locations. Buyers can use the address lookup tool and see the complete USDA map here.

USDA loans are especially a good program for first-time home buyers that have little cash savings for other loan programs that require a down payment. But even if you are a home buyer that has 3% or 5% or 10% for a down payment, you may want to still take a close look at the USDA loan. Why? monthly mortgage insurance!

The monthly mortgage insurance (PMI as most know) with a USDA loan is much cheaper per month when compared to FHA or conventional loans.

The USDA loan even allows the home seller to pay all the buyer’s closing costs resulting in little to zero out-of-pocket money from the home buyer. The primary hurdle to homeownership is down payment, especially for Georgia’s first-time homeowners. With the 100% USDA RD home mortgage, homeownership is still possible.

How To Check Your USDA Eligibility?

To be approved for this loan there are a few important requirements:

- First, the home must be located in a USDA eligible area. Again, most of GA outside major cities is approved for the program. If you find your location is not eligible, please contact us to discuss different low-down payment solutions like an FHA mortgage.

- Second, the household income must be below the set limits that are in place for each county. Click the link for more details on USDA income limits in Georgia.

As for USDA loan pre-approval, below we have listed some important factors:

- USDA credit score qualifications: 620 and above credit score is required by most lenders when financing 100%. Additional requirements may apply for any home buyers that have had past credit hardships like bankruptcy, short sale, foreclosure, etc

- Debt to income ratios (DTI): Lenders will take a look at your housing and total debt-to-income ratio. The PITI (mortgage principal, interest, taxes and home insurance) must be less than 30 percent of your monthly income. All additional monthly debt can be no more than 42 percent of your income. These limits can be slightly exceeded, sometimes with strong compensating factors (high credit scores, etc)

- Job History: Generally a solid two-year history is needed. Now, this does not need to be with the same employer, just more “continuous” This rule does not apply to recent college graduates. Homebuyers that have extended gaps in their employment can sometimes be approved with proper documentation explaining the gap (medical reasons, etc.)

Buyers should note that USDA Rural Development offers two different types of mortgage programs. The USDA direct program and the 502 Guarantee program. The USDA direct program is processed directly by the USDA. The 502 Guarantee program is processed only by approved lenders and banks. In most cases, lower-income borrowers will use the direct program. Moderate income households will use the 502 Guarantee program. The USDA 502 program makes up the large majority of USDA housing mortgages.

| USDA Direct Loan | 502 Guaranteed Loan (most buyers) | |

| Loan made by | USDA Directly | Third-party (such as a mortgage lender, broker, bank) |

| Use | Low-income consumers | Higher-income ranges |

| Income Standards | Household income less than 80% of area median | Household income less than 115% of the area median |

Want to learn more about USDA Rural Housing loans? Contact us 7 days a week by calling the number above, or just submit the short Info Request Form on this page.

Proud to serve all of Georgia including Valdosta, Thomasville, Tifton, Albany, Columbus, Atlanta, Macon, Savannah, Augusta, Athens, and Marietta.