Many home buyers ask what the current jumbo loan limits are for their specific county and state. The fact is, jumbo loan programs do not have a uniform set loan limit like conventional Fannie Mae or Freddie Mac mortgages. Standard conforming loans have loan limits set from $766,550 to $1,149,825 for high-cost locations in California, Florida, Massachusetts, Connecticut, DC, etc.

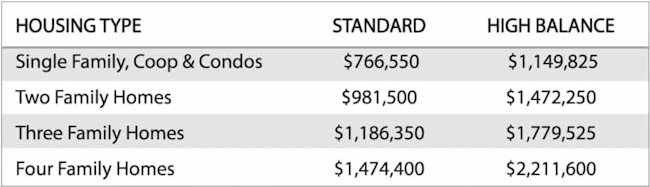

Many home buyers ask what the current jumbo loan limits are for their specific county and state. The fact is, jumbo loan programs do not have a uniform set loan limit like conventional Fannie Mae or Freddie Mac mortgages. Standard conforming loans have loan limits set from $766,550 to $1,149,825 for high-cost locations in California, Florida, Massachusetts, Connecticut, DC, etc.

Baseline Conforming Loan Limits for 2024:

However, with Jumbo loans, the loan caps are set by individual lenders and banks. Furthermore, the actual mortgage limit is based on many factors like the borrower’s credit profile, down payment amount, among other factors.

Below we have listed the current limits based on down payment and credit. Borrowers can learn more about all the jumbo loan down payment requirements here.

Home Buyers with 5% Down:

- The loan amount limit through 2024 is $1,500,000

- Borrowers should have a minimum 680 credit score for 95% financing.

- First and Second mortgage (combo) loan structures, along with single loan structures available. Both with zero monthly mortgage insurance costs.

Home Buyers with 10% Down:

- The loan amount limit is $2,000,000

- Borrowers should have a minimum of 660 credit for loan amounts below $1.5mil. Mortgages $1.5m-$2.0m will require a 720 score for 90% Jumbo financing.

- Just like above, multiple loan structure options with no PMI.

Home Buyers with 15% -20% Down:

- Loan amount limits

$3.5mil - 740 credit required for loans over $3mil

- No PMI.

Important Restrictions:

- All the programs listed above are reserved for owner-occupied and second homes only. Options are available for investor properties, however, they will require 20% down payment.

- All applicants should be able to provide full income and asset verification, as this is a “full doc” loan.

- Borrowers should also demonstrate proper payment reserve savings – after closing and down payment. The amount of reserves (3 months – 18 months) will depend on many variables like final loan amount, credit, and debt to income. Reserves are not required to be “liquid” accounts, retirement accounts are eligible.

- Buyers can choose from traditional fix rate terms like 30 yr, 15 yr, and adjustable rate terms. All programs require full principal and interest payments like regular conventional loans.

Final Notes:

- The requirement above also applies to rate-term reduction Jumbo Refinance. Cash-out refinance is also available at a reduced loan-to-value. More info on refinance options can be found on the Jumbo Loan page.

- Approved Veterans should also read about special VA Jumbo mortgages for eligible buyers.

Loan specialists can be reached 7 days a week to answer questions. Please call Ph: 800-962-0677 to learn more.

How do I find out what is a “high cost” location? I would like to purchase a home Austin Texas, is this high cost, what is the limit for a conventional loan?

Austin along with the entire state of Texas is not high cost. The conventional loan limit is $453,100, anything over this would be considered a Jumbo loan.

thank you.