New Jumbo financing options have emerged for 2024. Qualified borrowers in Dallas, Houston, Austin and San Antonio now have newly expanded low down payment Jumbo mortgage options. Some of these new options permit up to 95% making it possible to obtain financing without 20% down.

New Jumbo financing options have emerged for 2024. Qualified borrowers in Dallas, Houston, Austin and San Antonio now have newly expanded low down payment Jumbo mortgage options. Some of these new options permit up to 95% making it possible to obtain financing without 20% down.

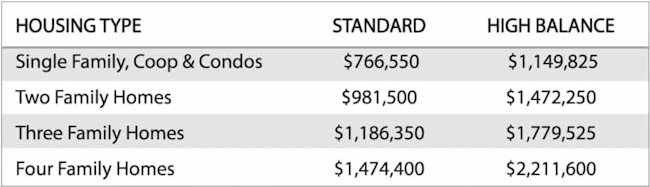

A mortgage is considered “Jumbo” when the final loan exceeds $766,550 – this is the current conforming loan limit throughout the entire state of Texas and most of the U.S. In years past, many borrowers were offered nearly no limited down payment flexibility when it came to Texas jumbo loans. * Please see the loan limits for muti-unit properties below.

Many banks, credit unions and lenders would require 20% down just to be approved. Today we will discuss the latest Jumbo financing updates and things homebuyers will need to know before applying.

Just like conventional loans, jumbo loans have set requirements regarding down payment, credit score, debt to income limits and documentation. All the requirements listed below apply strictly to owner-occupied, full-time primary residences.

Reduced Down Payment Options:

10% Down Payment

- Loan limit – the current loan amount limit for this program is $2,000,000

- Credit – Credit score requirements change based on the loan amount. Borrowers will need a 660 credit score when the loan amount is below $1 mil. Over $1 mil will require a 680 score. Up to $2 mil will require a 740 score.

- Loan Structure – Depending on the property state, borrowers will have a few options available regarding the loan structure. Single loan or 1st and 2nd mortgage combo options (80-10-10) are a popular way to reduce interest rates. Both options eliminate the need for monthly mortgage insurance. All options have fixed-rate and common adjustable-rate terms available – fully amortized principal and interest.

- Payment Reserves – all jumbo loans will require payment reserves. This is the amount of liquid and non-liquid funds available after down payment and closing costs. The amount will be based on credit, loan amount and down payment amount. However, 3-4 months of payment reserves are generally a min requirement. For higher loan amounts exceeding $2m, this requirement can increase to 9 months +

5% Down Payment

- Loan limit – the current Jumbo loan limit for this program is $1,500,000

- Credit – The credit score requirement is currently 680.

- Loan Structure – Depending on the property state, borrowers will have a few options available regarding the loan structure. Single loan or 1st and 2nd mortgage combo options (80-15-5) are a popular way to reduce interest rates. Both options eliminate the need for monthly mortgage insurance. All options have a fixed rate and common adjustable-rate terms available – fully amortized principal and interest.

- Payment Reserves – 0-6 months depending on the variables mentioned above.

Important Qualifying Notes:

- Eligible properties include 1-unit single-family homes, condominiums and townhomes. Vacant land, ranches, farms or any large acreage where the land value exceeds 30% of the total value is not permitted. Building a home on your own lot is permitted with special new construction financing. This does not include homes being sold directly by new home builders – spec homes for example. These transactions are viewed as the same as regular home sales.

- All properties must be a primary residence or second home for the maximum financing. Investment properties are permitted, but limited to 80% loan to value for loan amounts below $1.5mil. Higher loan amounts will require a 25%-30% min down payment.

- All programs require full documentation of buyers’ income and assets. Tax returns, W2s (if regularly employed) banking and asset statements. Self-employed borrowers require a min (2) years of tax returns.

- All standards listed above also apply to Jumbo refinance – rate/term reduction programs. Homeowners searching for a cash-out refinance can do so with eligible equity. However, these programs will be more limited on max loan to value, generally a 90% limit.

- Eligible military Veteran? You may also have special VA high-balance options available. Read more about VA Jumbo mortgages here.

Homebuyers can learn more about any of the programs above by contacting Jumbo Mortgage Source

Are the 5 percent down payment Jumbo programs also available in other Texas towns, like El Paso?

Yes, the program is available to all qualified home buyers, in all 50 states.