The USDA home loan program is limited to certain eligible areas deemed “rural” by the USDA/Rural Development. We frequently receive questions about the areas in Florida that are eligible for the program.

The USDA says that to be eligible a property must be in a rural community of fewer than 10,000 people, but there are exceptions to this rule. Some areas between 10,000 and 30,000 in a population are considered rural due to their distance from urban areas.

Questions? We are here to help 7 days a week. Please contact us by calling the number above, or just submit the short info request form on this page (mobile users will find the form at the bottom)

Broward, Monroe, Duval, Pinellas County and “most” of South Florida (Miami/Dade) are not eligible for USDA financing. The good news is about 80% of Florida IS eligible for USDA financing.

Some Florida USDA Mortgage Approved Locations Include:

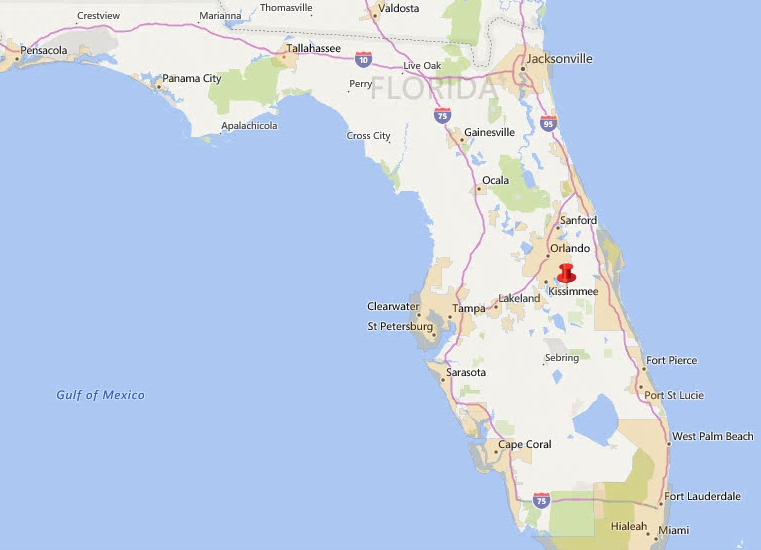

Many locations outside of Orlando like Ocoee, Winter Garden, Kissimmee in Osceola and Polk County, may still be eligible.

Locations outside of Tampa like Riverview, Valrico, Ruskin, Sun City, Manatee County, Wesley Chapel, Odessa, and Pasco County still have approved areas.

Communities just outside of Jacksonville and Duval County, like St. John’s County outside of St. Augustine, Clay County, Green Cove Springs, and Nassau County still have eligible areas.

You can find the latest 2024 USDA map here to view all the eligible areas nationwide and even search for a specific property address. Sometimes “less info is better” when using the map search function, input the street number, and property address with zip code only (leave out the city/state) if you are having trouble. The Florida USDA mortgage map below shows the darker shaded areas that are NOT eligible. Everything else in white is an approved area.

Please note, in order to use the program the house is not required to have a “special” designation by USDA. This means any home listing (for sale by owner, realtor, etc.) is generally perfectly fine. Remember, the actual location of the property is the key factor.

The home must also meet the minimum HUD standard as it relates to livability and safety, pretty much the same as other government-backed loans. As long as the property is eligible according to the map, and in overall good repair, it should be eligible for financing through any USDA-approved lender, broker or bank.

Home buyers that need assistance checking a property’s eligibility should connect with us today for assistance.

Florida USDA Loan Advantages Include:

- 100% Financing, no down payment needed.

- The buyer’s closing costs can also be paid by the home seller, thus limiting out-of-pocket expenses.

- Closing costs can also be added to the buyer’s loan assuming the appraised value is high enough to support it.

- Safe and secure 30-year fix rate terms with low-interest rates. USDA Rural Housing is a Government backed program with no early payoff penalty.

- Not limited to strictly first-time buyers, all qualified home buyers can apply.

- Lower monthly mortgage insurance costs (PMI) when compared to Conventional or FHA loans.

- Lower credit scores are often accepted down to 620 for 100% financing. Even lower credit is acceptable for home buyers that have a 3.5%-5% down payment. More: Some helpful tips from FICO on how to improve your credit score.

Ready to get started or want to learn more about the USDA approval requirements? Just call us at Ph: 800-743-7556 or submit the Info Request Form on this page 7 days a week.

Ready to get started or want to learn more about the USDA approval requirements? Just call us at Ph: 800-743-7556 or submit the Info Request Form on this page 7 days a week.

Apopka | Aventura | Boca Raton | Bradenton | Brandon | Cape Coral | Clearwater | Clermont |Cocoa Beach | Coconut Creek | Coral Gables | Crestview | Crystal River | Daytona Beach | DeLand | Deltona | Delray Beach | Destin | Dunedin | Englewood | Fernandina | Flagler Beach | Fort Lauderdale | Fort Myers | Fort Pierce | Fort Walton Beach | Gainesville | Green Cove Springs | Hallandale | Hobe Sound | Hollywood | Homestead | Inverness | Jacksonville | Lakeland | Lake City | Lake Mary | Live Oak | MacClenny |Melbourne | Miami | Milton | Mount Dora | Naples | Ocala | Ocoee |Ojus | Orange Park | Orlando | Ormond Beach | Palatka| Palm Bay | Panama City | Pensacola | Pompano Beach | Port Charlotte | Port St. Lucie | Punta Gorda | Santa Rosa | Sarasota | Siesta Key | Springhill | St. Augustine | St. Petersburg | Sunny Isles | Tallahassee | Tamarac | Tampa | Titusville | Venice | Vero Beach | Weeki Wachee | Wesley Chapel | West Palm Beach | Winter Garden | Winter Haven | Winter Park | Winter Springs | Zephyrhills

Alachua | Baker | Bay | Bradford | Brevard | Broward | Calhoun | Charlotte | Citrus | Clay | Collier | Columbia | Dade | De Soto | Dixie | Duval | Escambia | Flagler | Franklin | Gadsden | Gilchrist | Glades | Gulf | Hamilton | Hardee | Hendry | Hernando | Highlands | Hillsborough | Holmes | Indian River | Jackson | Jefferson | Lafayette | Lake | Lee | Leon | Levy | Liberty | Madison | Manatee | Marion | Martin | Monroe | Nassau | Okaloosa | Okeechobee | Orange | Osceola | Palm Beach | Pasco | Pinellas | Polk | Putnam | St. Johns | St. Lucie | Santa Rosa | Sarasota | Seminole | Sumter | Suwannee | Taylor | Union | Volusia | Wakulla | Walton | Washington | County

I’m buying a NEW single family house in Lakeside Landings, Winter Haven 33881. I check the eligibility map and says that the address in not located in an eligibility area.

Since the property is less that 4 miles form the next availability area, (just crossing US 27 HWY), it’s there could be an exception?

Your prompt response will be highly appreciated! Thanks

Madeline

No exceptions regarding the eligibility lines. thank you for your question.

I have interest in St Petersburg. Which areas qualify? Apartment also qualify?

Pinellas county is not eligible for USDA loans. However, there are some USDA approved areas not far from St. Pete in Hillsborough and Manatee County.

I want to purchase a home near Orlando what areas would apply?

Please see the USDA eligibility map here – http://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do

Some popular locations around Orlando like Winter Garden, etc, are still eligible.

How do I get more information on USDA Loans… looking in LaBelle FL

just submit the info request form on this page, or give us a call at 800-743-7556

Hi how do I go about applying for one of these loans , my credit is pretty fair but no down payment.

Just submit the quick info request form on this page to be contacted.

I am interested to buy a house with the USDA program around ucf ( university central Florida) 32826 in orlando. Do you know if is eligible for usda.

That area would likely not be eligible – you can check all the eligible approved USDA locations in Orange, Seminole, and Osceola Counties here

https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do

Are there still homes in Pasco County that meet the USDA approval standards?

For sure, many locations in Pasco are still eligible for USDA Rural Housing.

Is Ocala Fl an eligible area for this loan???

Not the immediate area of Ocala, but some of the communities surrounding Ocala in Marion County are eligible.

I will be relocating to central Florida in the next 24 months or so and was wondering if St. Cloud, FL would fall under an eligible area for a USDA loan? Also, if the down payment is below 20% , does that mean that a PMI will be applied to the loan?

Thank you

Select parts of St. Cloud are currently eligible. However, the eligible locations/ maps could change in the next few years. You can check any address or location in the map link included. The annual fee or PMI is required for all USDA loans.

What about areas outside of Jacksonville in Clay County? Are they approved for a USDA house loan?

Yes, select locations around Green Cove Springs, etc.