USDA loans have remained a popular option for Louisiana homebuyers that are looking for a more affordable mortgage solution with no down payment. These loans are backed by the United States Department of Agriculture (USDA) and were originally designed to help promote rural development and homeownership.

USDA loans have remained a popular option for Louisiana homebuyers that are looking for a more affordable mortgage solution with no down payment. These loans are backed by the United States Department of Agriculture (USDA) and were originally designed to help promote rural development and homeownership.

One of the biggest advantages of USDA loans is that they are still 100% financing, making them especially helpful for first-time homebuyers in Louisiana. The program does have a few key requirements related to eligibility that we will first discuss below.

Louisiana USDA Loan Eligibility:

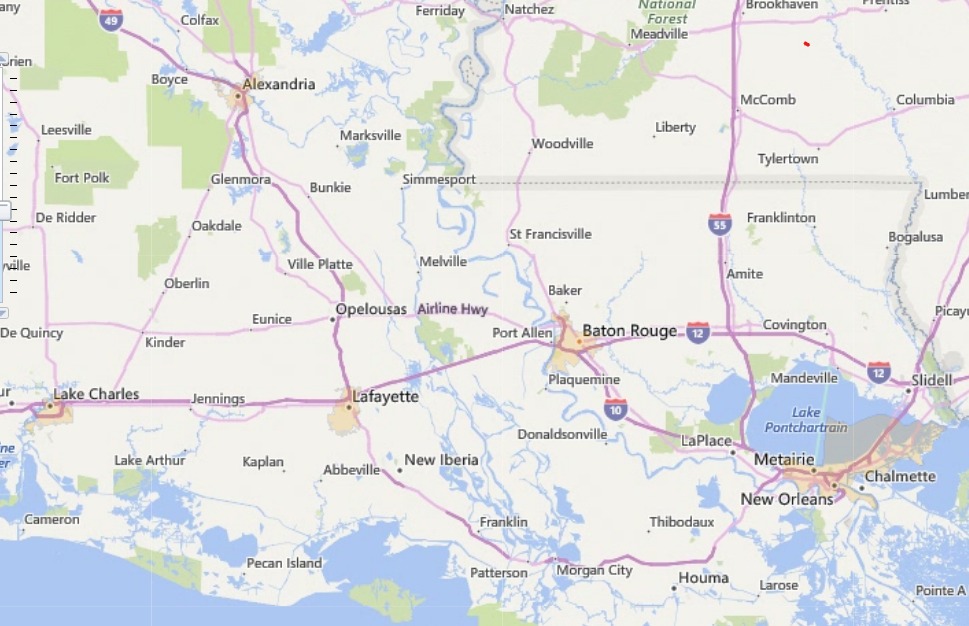

- USDA Property Location: The USDA Rural Housing program is designed to help expand rural locations by providing affordable mortgage solutions. This means the program likely won’t work for homebuyers purchasing a home in the main cities like New Orleans, Baton Rouge, Metairie, Lafayette or Shreveport. However, many of the outlying suburban areas around these cities that may not seem “rural” could be eligible. Please find the USDA eligibility map here. Remember, the home seller is not the concern with USDA, any qualified single family home in good repair should be fine. The primary concern is where the home is physically located. Please see the map below, the darker shaded areas represent the areas that are not eligible for the program. Buyers can look up their exact property address by using the map above. Please contact us today to discuss your location in detail.

- USDA Household Income: USDA Rural Housing has income limits for the household. The current income limits are $110,650 gross income for a standard family of 1–4 members. Income limits are even higher for larger families with 5+ members. The 2024 income limits are based on the county where the home is located, and these income limits apply to all income generating members of the family, even if they aren’t listed on the actual loan application.

Steps For USDA Loan Approval:

- Once home buyers decide they meet the eligibility factors listed above, they will want to ensure all loan qualifying requirements can be met. USDA is much the same as other mortgage programs like FHA, etc. There are minimum credit standards that must be met in order to qualify for a USDA loan. These credit standards may vary slightly by lender, but most require a 620 credit to be approved for 100% financing. Slightly lower credit scores can also be approved for borrowers that have 5%+ down payment.

- Debt-to-income ratio is also a key factor when determining the approved loan amount. Your total debt ratio should not exceed 41% of your gross monthly income. This means that all the applicant’s monthly debts (including the new mortgage payment, taxes, home insurance, and any other outstanding monthly loan or credit card payments) should not exceed 41% of their monthly income.

- In addition to meeting credit and DTI requirements, borrowers must also have a decent job history and proof of steady income for at least the past two years. This can include pay stubs, W-2 forms, and tax returns. Self-employed individuals may need to provide additional documentation, such as profit and loss statements or business tax returns.

If you do qualify for a USDA loan, it’s important to understand the costs associated with it. Like all mortgages, there will be closing costs involved such as appraisal fees, title insurance, and origination fees. However, one major benefit of a USDA loan is that there is no down payment required, and the home seller can pay all the buyer’s closing costs and pre-paid escrows.

If you do qualify for a USDA loan, it’s important to understand the costs associated with it. Like all mortgages, there will be closing costs involved such as appraisal fees, title insurance, and origination fees. However, one major benefit of a USDA loan is that there is no down payment required, and the home seller can pay all the buyer’s closing costs and pre-paid escrows.

If you’re looking to buy a home in Louisiana and are interested in a low down payment option, then USDA rural housing may be a viable solution for you. Unlike traditional loans that require a large down payment, USDA rural housing allows eligible homebuyers to purchase a home with little to no money down. This can make homeownership more accessible and affordable for those who may not have saved up enough for a traditional down payment.

Want to learn more? Please connect with us 7 days a week by calling the number above, or just submit the Info Request Form on this page.