Many California teachers purchasing homes are generally always first time home buyers. And like most first time home buyers, down payment is often the main issue when purchasing a home. Most first time buyers just don’t have 10 or 20 percent down payment needed for a mortgage down payment. The good news is you still have 100% financing options assuming you meet the basic USDA eligibility criteria.

Many California teachers purchasing homes are generally always first time home buyers. And like most first time home buyers, down payment is often the main issue when purchasing a home. Most first time buyers just don’t have 10 or 20 percent down payment needed for a mortgage down payment. The good news is you still have 100% financing options assuming you meet the basic USDA eligibility criteria.

USDA Rural Housing still allows for 100% financing in select rural defined locations around California. This government-backed 30 year fix loan is perfect for all public service workers including teachers, police, firefighters, etc. Please call us at Ph: 800-743-7556 anytime with questions anytime.

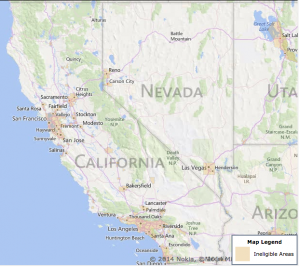

USDA 502 Guaranteed loans only have two key factors when determining if you are eligible, the location of the home and household income. Basically, the property must be located in a USDA approved area according to the USDA eligibility map here. Remember, the program is not limited to certain home sellers only, just where the home is located as it must be a “rural” defined location.

Most populated locations around LA, San Francisco, San Diego, etc will not be eligible for the program. But a lot of the overall landmass in CA is. Buyers can see the USDA California overview map below, the dark areas represent locations that are not eligible for the program. Please check the property address on the map link above, or just contact us by submitting the shot info request form on this page.

Note: Home buyers not eligible for USDA financing can learn more about other low down payment solutions like FHA loans here.

In addition to the location of the house, the income for the entire household must be below the USDA income limits here. Keep in mind the household income limits are based on many factors like family size, location, etc.

If you find you meet the two key USDA loan eligibility factors above, everything else comes down to loan qualifying. Pre qualifying for a USDA loan is pretty much the same as other loan programs. Your credit score must be a min of 620 to be accepted by most banks and lenders. Your income should be documented with a stable two-year job history as well. Since USDA doesn’t have set loan amount limits, your monthly debt to income ratios will determine the purchase price amount you qualify for.

USDA loans offer many advantages including:

- 100% financing

- Government-backed – secure fix interest rates

- Home sellers are permitted to pay buyers closing costs

- Most single-family homes, town homes, etc that are in generally good repair and located in an approved area are permitted for financing. Note, existing mobile homes or large acreage (farms) are not permitted

- No minimum saving requirements for the home buyer

- No recapture or early loan termination penalties

- No home buyer class or education requirements required

Please connect with us today to learn more about the application process, happy to service all of CA including Bakersfield, Fresno, Fremont, Modesto, Fontana, Berkeley, Fairfield, Temecula, San Mateo

Leave a Reply