Florida Jumbo Loan Requirements: For those Florida home buyers seeking higher loan amounts (over $766,550) a Jumbo mortgage may be the right answer. Jumbo loan guidelines have continued to relax over the last few years. As home values continue to rise, mortgage companies are experimenting with loosening up lending standards on jumbo loans as a way to increase their volume.

Florida Jumbo Loan Requirements: For those Florida home buyers seeking higher loan amounts (over $766,550) a Jumbo mortgage may be the right answer. Jumbo loan guidelines have continued to relax over the last few years. As home values continue to rise, mortgage companies are experimenting with loosening up lending standards on jumbo loans as a way to increase their volume.

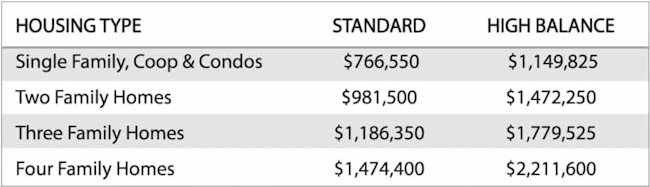

Select lenders are now offering Jumbo loans with only a 5% down payment in Florida and other states. In 2024, mortgages are considered “jumbo” amounts when they exceed $766,550. However, in some of the most expensive high-cost markets, the jumbo threshold doesn’t start until $1,149,825.

Note: the only high-cost location in Florida is Monroe County and the current conventional loan limit is $929,200 for a single 1-unit property. Please find the complete 2024 conforming loan list here.

Most of the Jumbo loans today will require full documentation. This means being able to properly document all income, and assets among other things. Fixed and 3,5,7,10 year adjustable rate terms are still available with Jumbo loans.

Many jumbo loan options today do not require monthly PMI to be paid. There are also financing options for vacation homes, 2nd homes, and investment property purchases. However, any property that is NOT a primary home will require a larger down payment. 95% Jumbo financing is only available for owner-occupied homes – up to $1,500,000 loan amounts. A loan amount greater than $1.5m-$2m may require a larger down payment of 10%. See the latest requirements and Jumbo loan guidelines here.

Most of the higher LTV (90%, 95%) Jumbo loans today will require 700 credit scores to be considered for financing.

Some self-employed Jumbo applicants may have trouble documenting income, etc. For those borrowers, a non-conventional loan may be better suited. Most of the non-conventional loan programs today allow for reduced documentation, flexible fixed-rate and ARM terms.

Some self-employed Jumbo applicants may have trouble documenting income, etc. For those borrowers, a non-conventional loan may be better suited. Most of the non-conventional loan programs today allow for reduced documentation, flexible fixed-rate and ARM terms.

Like above, they allow for the purchase of second homes and investment homes. These are the highest-risk loan due to the higher loan amounts and reduced documentation. As a result, borrowers can expect to pay a slightly higher down payment and interest rate.

Homeowners that already have a Jumbo loan and want to refinance via “rate/term” or “cash-out” please contact us to discuss the latest requirements. We offer Jumbo refinance options for primary, secondary and investment properties

Happy to serve Miami Dade, Brickell, Coconut Grove, Tampa, Jacksonville, West Palm Beach, Naples, Sarasota, Boca, Daytona, Orlando, Key West, St. Petersburg, please contact us here with questions.

Is this jumbo program also available in Georgia, Atlanta to be specific.

For sure, 90% and 95% options are available for all 50 states!

Are there options to get around paying mortgage insurance? I know some lenders can break up the loans into two separate to avoid the mortgage insurance costs?

Yes, in most cases when the buyers down payment is less than 20%, the loan structure will be broken up to avoid PMI. This can be done by 80% first mortgage and 15% second, in the case of 5% down. Or 80-10 option when the down payment is 10%. In some cases, there are also single loan 95% or 90% options that do not require PMI. What option will be best for you will depend on many factors like property location, loan amount and qualifying characteristics.

Is this just fix rate loans with principal and interest payments?

Thank you for your question. All common fix rate and adjustable rate terms available with the normal principal and interest payment. Jumbo interest only amortization is available on a limited base for those applicants with higher payment reserves. Negative amortization is not available.

I would like to talk to someone about a jumbo loan in Clearwater. Thank you